- TON ha disminuido un 14,64% durante el último mes.

- Los fundamentos del mercado indicaron un cambio en el sentimiento del mercado, de bajista a alcista.

Durante el último mes, el mercado de las criptomonedas ha experimentado un fuerte repunte, con Bitcoin [BTC] alcanzando un máximo local de 69.000 dólares.

Sin embargo, durante la semana pasada, el mercado se enfrió y la mayoría de las criptomonedas se volvieron negativas. Por lo tanto, las pérdidas recientes han comenzado a compensar las ganancias mensuales.

Una de las altcoins más exitosas fue Toncoin. [TON]. Desde que alcanzó un máximo mensual de 5,8 dólares, TON ha experimentado una caída significativa.

De hecho, en el momento de escribir este artículo, Toncoin se cotizaba a 4,95 dólares. Esto marcó una caída del 2,42% durante el último día.

Del mismo modo, la altcoin ha caído un 14,64% mensual, con una extensión de esta tendencia bajista del 6,06% en los gráficos semanales.

En particular, las condiciones imperantes en el mercado han dejado a la comunidad criptográfica deliberando sobre la trayectoria de la altcoin.

Uno de ellos es el popular analista criptográfico.[TON}.%20As%20such,%20since%20hitting%20a%20monthly%20high%20of%20$5.8,%20Ton%20has%20experienced%20a%20significant%20decline.%20In%20fact,%20as%20of%20this%20writing,%20Toncoin%20was%20trading%20at%20$4.95.%20This%20marked%20a%202.42%%20decline%20over%20the%20past%20day.%20Equally,%20the%20altcoin%20has%20dipped%20by%2014.64%%20on%20monthly%20with%20an%20extension%20to%20this%20bearish%20trend%20by%206.06%%20on%20weekly%20charts.%20Notably,%20the%20prevailing%20market%20conditions%20have%20left%20the%20crypto%20community%20deliberating%20over%20the%20altcoin’s%20trajectory.%20One%20of%20them%20is%20the%20popular%20crypto%20analysts%20Ali%20Martinez%20who%20has%20suggested%20Ton’s%20current%20conditions%20provides%20buying%20opportunity.%20TON%20TD%20Sequential%20shows%20a%20buy%20signal%20In%20his%20analysis,%20Martinez%20posited%20that%20TD%20sequential%20shows%20a%20buy%20signal%20on%20Toncoin’s%2012-hour%20charts.%20According%20to%20him,%20this%20suggests%20a%20potential%20price%20rebound%20in%20the%20near%20future.%20In%20context,%20what%20this%20means%20is%20that%20selling%20pressure%20is%20a%20warning%20and%20the%20bears%20are%20losing%20momentum.%20When%20sellers%20lose%20momentum,%20buyers%20can%20enter%20the%20market%20at%20lower%20prices%20thus%20creating%20buying%20pressure.%20As%20the%20buy%20signal%20has%20appeared,%20it%20has%20resulted%20in%20increased%20trading%20activities.%20Thus,%20Trading%20volume%20for%20Ton%20has%20surged%20by%20126%%20to%20$313.1%20million%20on%2024-hour%20charts.%20This%20suggests%20that%20most%20likely%20traders%20are%20entering%20the%20market%20buying%20at%20lower%20prices.%20Therefore,%20if%20the%20market%20follows%20through,%20the%20prices%20will%20rebound%20and%20see%20further%20gains%20on%20price%20charts.%20What%20Ton%20Charts%20Suggest%20Although%20Ton%20has%20experienced%20a%20sustained%20decline,%20the%20current%20conditions%20suggest%20bears%20have%20exhausted%20and%20the%20altcoin%20could%20see%20gains%20on%20price%20charts.%20For%20example,%20Toncoin’s%20large%20holder’s%20Netflow%20to%20exchange%20netflow%20ratio%20has%20declined%20from%20a%20monthly%20high%20of%20289%%20to%2070%.%20This%20shows%20a%20shift%20in%20sentiment%20with%20large%20holders%20accumulating%20their%20assets%20as%20they%20anticipate%20more%20gains.%20Such%20a%20decline%20suggests%20market%20confidence.%20Additionally,%20Toncoin’s%20Aggregated%20exchanges%20total%20outflows%20have%20increased%20from%20a%20low%20of%201.86%20million%20tokens%20to%207%20million%20Ton.%20This%20shows%20that%20most%20investors%20are%20withdrawing%20their%20Ton%20from%20exchanges%20to%20store%20in%20cold%20wallets.%20Such%20behavior%20suggests%20that%20investors%20are%20confident%20in%20the%20altcoin’s%20future%20prospects.%20Simply%20put,%20Ton%20is%20experiencing%20a%20shift%20in%20market%20sentiment%20from%20bearish%20to%20bullish.%20Therefore,%20if%20this%20sentiment%20holds,%20Ton%20will%20reclaim%20a%20higher%20level.%20Thus,%20the%20altcoin%20will%20attempt%20a%20$5.4%20resistance%20level%20in%20the%20near%20term.%20A%20breakout%20from%20this%20level%20will%20see%20Ton%20reach%20$5.8.%20However,%20if%20bulls%20fail%20to%20take%20over%20the%20market,%20a%20further%20decline%20will%20see%20a%20drop%20to%20$4.02.” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>Ali Martinez, who suggested that TON’s current conditions signaled a buying opportunity.

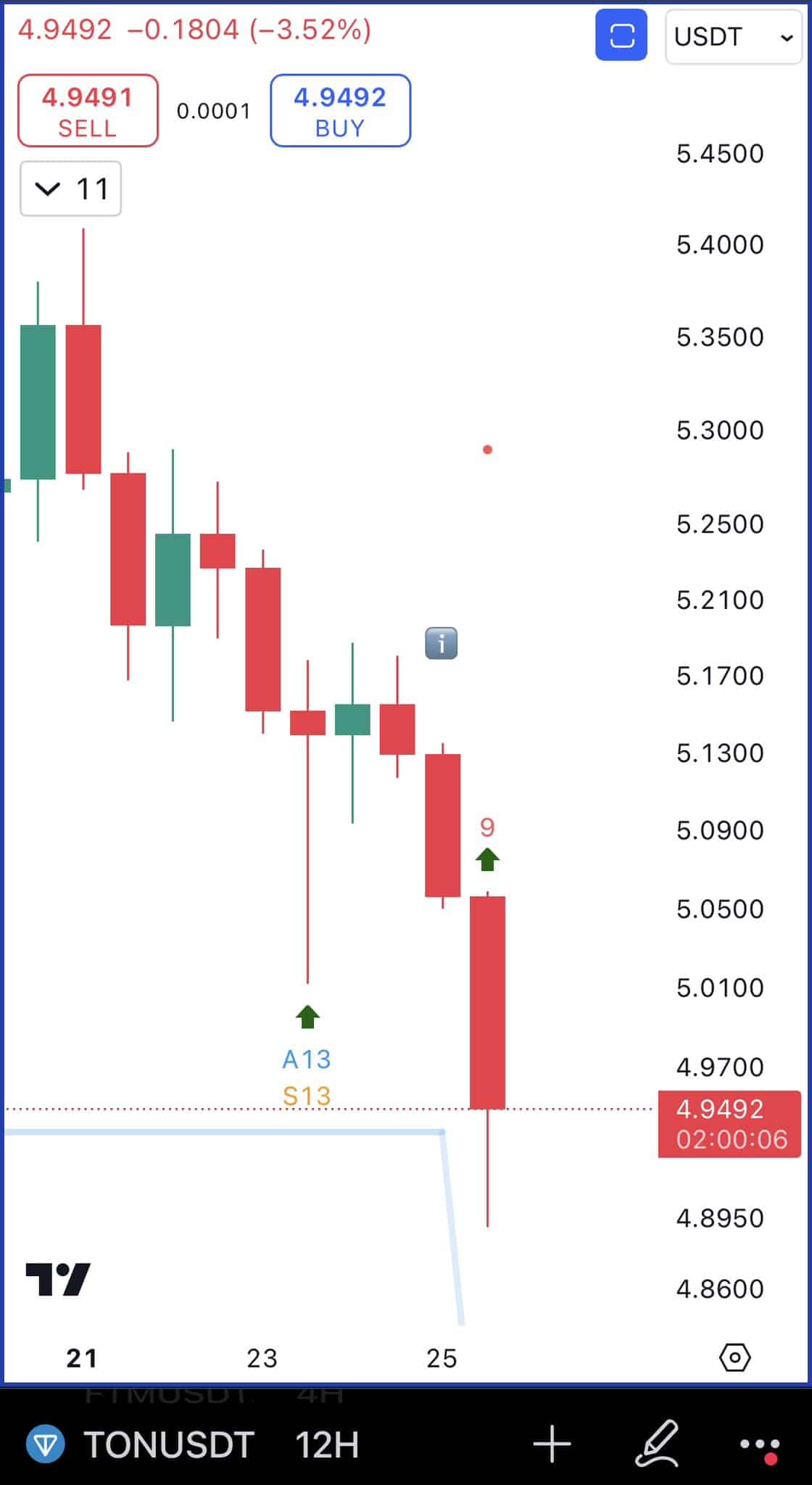

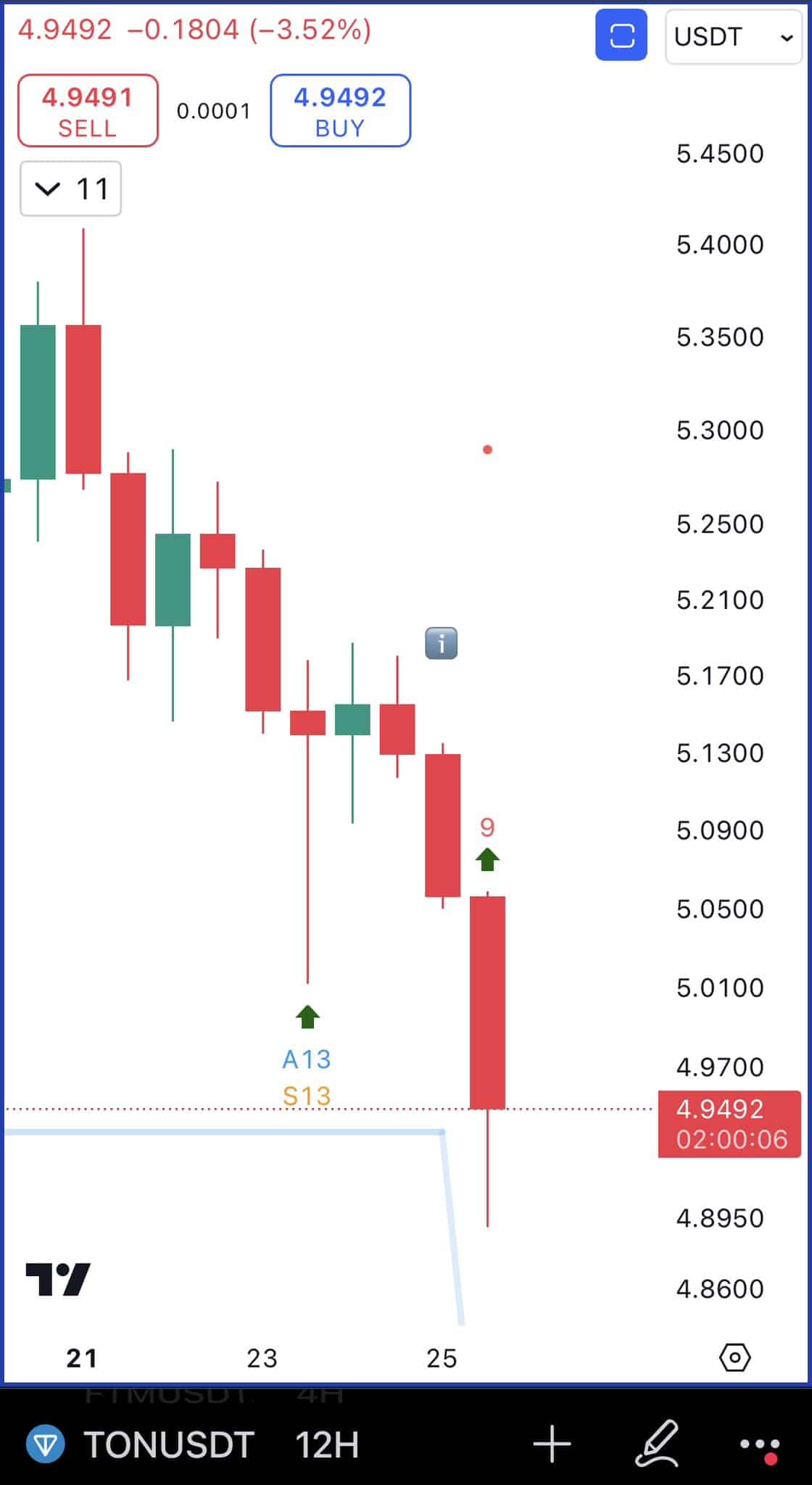

TON shows a buy signal

In his analysis, Martinez posited that TD sequential showed a buy signal on Toncoin’s 12-hour charts. This suggested a potential price rebound in the near future.

Source: X

What this means is that selling pressure is a warning, and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices, thus creating buying pressure.

The appearance of the buy signal has resulted in increased trading activities over the past day. Thus, TON’s trading volume has surged by 126% to $313.1 million. Thus, most traders were entering the market at lower prices.

If the market follows through, the prices will rebound and see further gains on price charts.

Gains ahead?

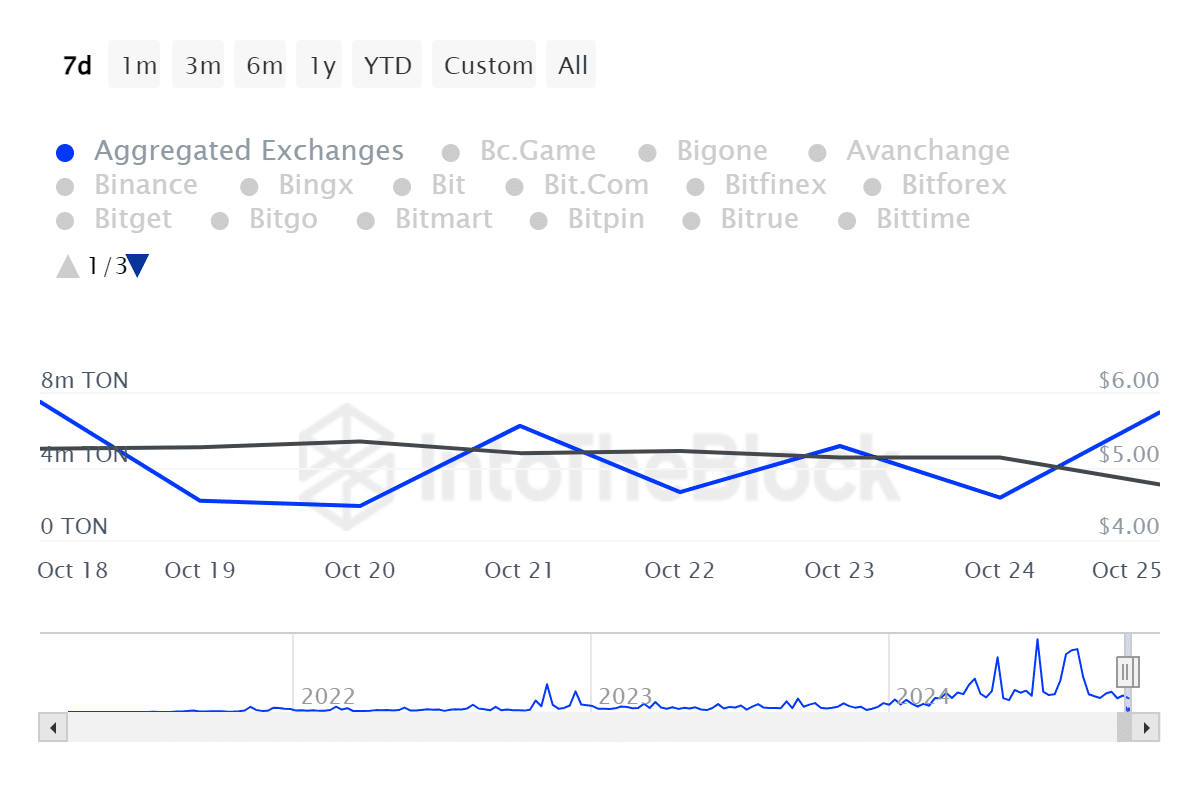

Although TON has experienced a sustained decline, the current conditions suggested that the bears were, and the altcoin could see some gains ahead.

Source: IntoTheBlock

For example, Toncoin’s large holder’s Netflow Ratio has declined from a monthly high of 289% to 70%. This showed a shift in sentiment, with large holders accumulating their assets as they anticipated more gains.

Such a decline suggested market confidence.

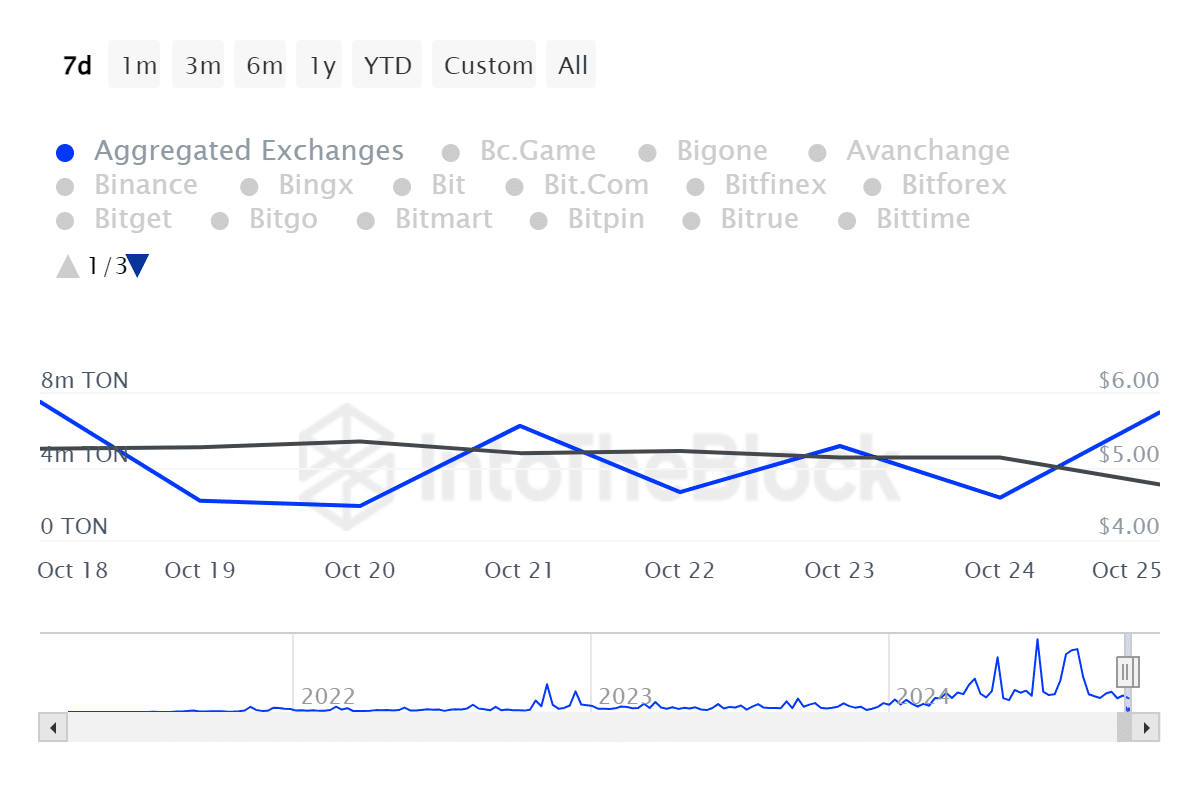

Source: IntoTheBlock

Additionally, Toncoin’s total outflows on Aggregated Exchanges increased from a low of 1.86 million tokens to 7 million.

This showed that most investors were withdrawing their Ton from exchanges to store in cold wallets. So, investors seemed confident in the altcoin’s future prospects.

Read Toncoin’s [TON] Predicción de precios 2024-2025

En pocas palabras, TON estaba experimentando un cambio en el sentimiento del mercado de bajista a alcista en el momento de esta edición. Si este sentimiento se mantiene, Ton recuperará un nivel más alto.

Por lo tanto, la altcoin podría intentar alcanzar un nivel de resistencia de $5,4 en el corto plazo. Una ruptura desde este nivel hará que Ton alcance los 5,8 dólares. Sin embargo, si los alcistas no logran apoderarse del mercado, una nueva caída hará que TON caiga a 4,02 dólares.